SmartRide tracks safe driving data and SmartMiles tracks daily driving distance to help customers save money

As one of Mosaic’s numerous insurance carriers, Nationwide gives us access to all kinds of programs and features that are constantly changing to improve the customer experience. Telematics, also known as usage-based insurance, is the future because it hones in on a customer’s specific situation and gives them more control over cost. It is solely a discount based on good driving actions of the customer, keeping the coverage on the vehicle the same.

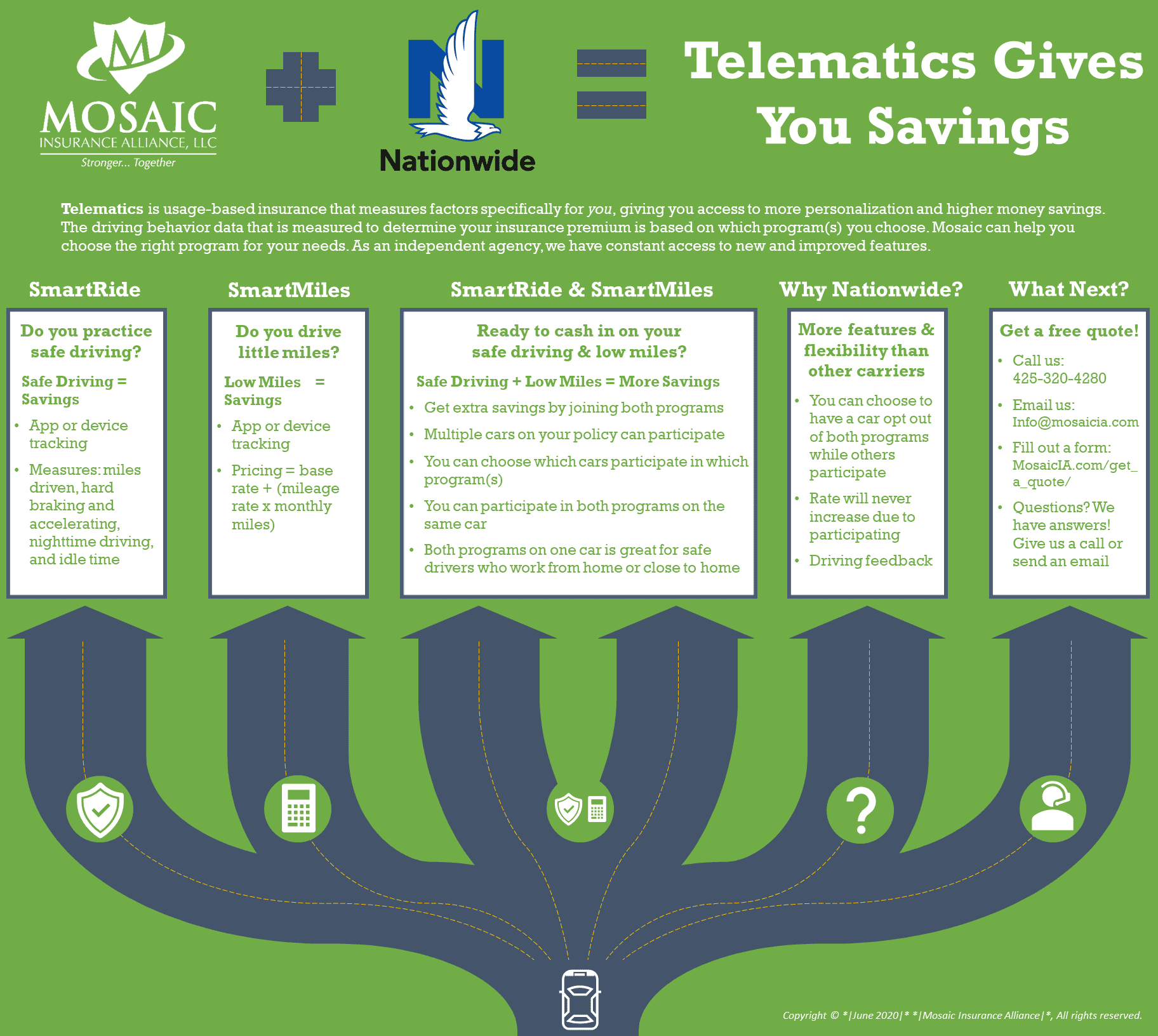

Nationwide’s telematics programs vary from that of other carriers, and the variations give Mosaic additional options to help clients like you keep the same reliable car coverage, while saving money and having more personalization options. Below is a condensed version of how Nationwide’s Telematics programs can give you savings. If you would like to download the PDF of the infographic below, you can do so here. Read-on for more details highlighted in the graphic.

What kind of savings could you see from SmartRide?

When first enrolling in SmartRide, you would get an automatic 10% participation discount. Afterwards, discounts are given based on safe driving data. You can get up to a 40% discount for safe driving, and the national average is 21%.

The safer you drive, the higher your savings.

To track safety, you would either use the SmartRide app on your cellphone or you would plug a device directly into your car. You have the option to choose which method, but you might have to use the app if your car is older than 1996 and does not have the compatible adaptor to use the physical device.

Data time duration depends on enrollment date, but it is typically 4-6 months. You can track your rating over the duration for a discount estimate. If you use the plug-in device to track data, only the enrolled vehicles get the discount. If all drivers on your policy uses the app to track data, discounts are averaged and then a final car insurance discount is applied to every vehicle on the policy. The discount will be applied at your next policy renewal and will remain on future policy terms if you stay an auto insurance client.

To measure safe driving effectively, Nationwide considers factors that increase the likelihood of an accident:

- Miles driven. The more miles driven, the higher chances of getting into an accident.

- Hard braking and accelerating. Coming to a sudden stop, decreasing speed significantly, and punching the gas can cause accidents and/or traffic violations. It is also commonly an indicator that the driver might not be paying adequate attention. Nationwide considers hard braking as “a slowing in excess of 7.7 mph per second.”

- Night driving. Driving late, typically in the hours of midnight-5 am increases the likelihood of being in an accident.

- Idle time. Stop-and-go traffic increases the chances of getting into an accident than traffic that is flowing at a steady pace. Bad traffic on the highway, having to stop at multiple streetlights and stop signs, construction zones that are causing a car to constantly stop, etc. increase the chances of hitting another car.

Is SmartMiles also something worth your while?

If you do not drive a certain vehicle on your policy very often, then SmartMiles can help you save money on that car. This program is great if you work close to home, work from home, use public transportation frequently, have a car you do not drive often, have a classic car that is only driven part of the year, and the like.

With this coverage, data tracking happens until the program is no longer desired, and monthly payment uses this formula: base rate + (actual miles driven x rate per mile). When first signing up, an agent will set the base rate and cost per mile and estimate the monthly mileage for the first payment. After the first month, actual mileage will be counted for the following month’s bill. For example, if Sam signs up in the beginning of June, his June bill will have the estimated miles factored in and real miles will start being tracked for July’s bill. If Sam has a base rate of $40 and he drives 100 miles in June with a rate of $0.06 per mile, then for the month of July, his bill would be $46 ($40 base rate + (100 miles x $0.06 per mile)).

Mileage driven is determined by an app or in-car plug-in device like with SmartRide. You can track your miles online to get an idea of your next bill cost. Also, only the first 250 miles will be calculated in a day, so if you decide to take your car on a road trip, it will not cost a fortune.

Why Nationwide?

Telematics are not a new thing amongst auto insurance carriers. However, Nationwide offers more opportunities than the average insurance agency.

- There is no cost to participate in any of the programs.

- You will not receive any increase in coverage due to participating.

- For SmartMiles, the base rate and mileage rate will remain the same over time unless the policy changes.

- You can choose what is best for you based on your driving habits with each of your cars on the policy. While all cars on the policy can participate in a program(s), they do not have to participate at all, nor do they have to participate in the same program. A car can also do both programs.

- Additional opportunities for discounts. For example, if you participate in the program(s), you can receive an additional discount if you bundle your home and auto insurance.

Have any questions, or interested in getting a free quote? Mosaic loves questions and is ready to help you in any way possible. Give us a call at (425) 320-4280, or email us at info@mosaicia.com.